Hello, hello, hello!

Welcome to the very first episode of our No-Nonsense Study Abroad Newsletter – where we keep it raw, real, and straight to the point. No BS, no sales pitch—just the insider info you actually need.

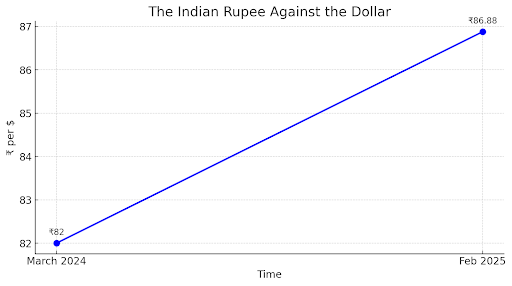

And today, we’re kicking things off with something you literally cannot ignore, something that's all over the news lately—the falling Indian Rupee (₹) and what it means for your study abroad journey.

You must be wondering why we're talking about this in our first episode?

COST.

This one factor makes or breaks a lot of study abroad dreams, and I don’t want yours to be one of them. So, read carefully.

Let’s dive in!!

The weakening of the Indian Rupee (₹) means that every $ or € you spend costs more rupees. Sounds scary, right? Lemme explain!

For Example:

If your tuition fee was $25,000 when the exchange rate was ₹82/$ (March 2024), it would have cost you ₹20,50,000. But today, with the rupee at ₹86.88/$, that same fee now costs ₹21,71,000—a jump of ₹1.2L!

But does this mean you should cancel your study abroad plans?? Definitely not.

Today, I’ll help you with four solid ways to save money while studying abroad!! Let’s start!!