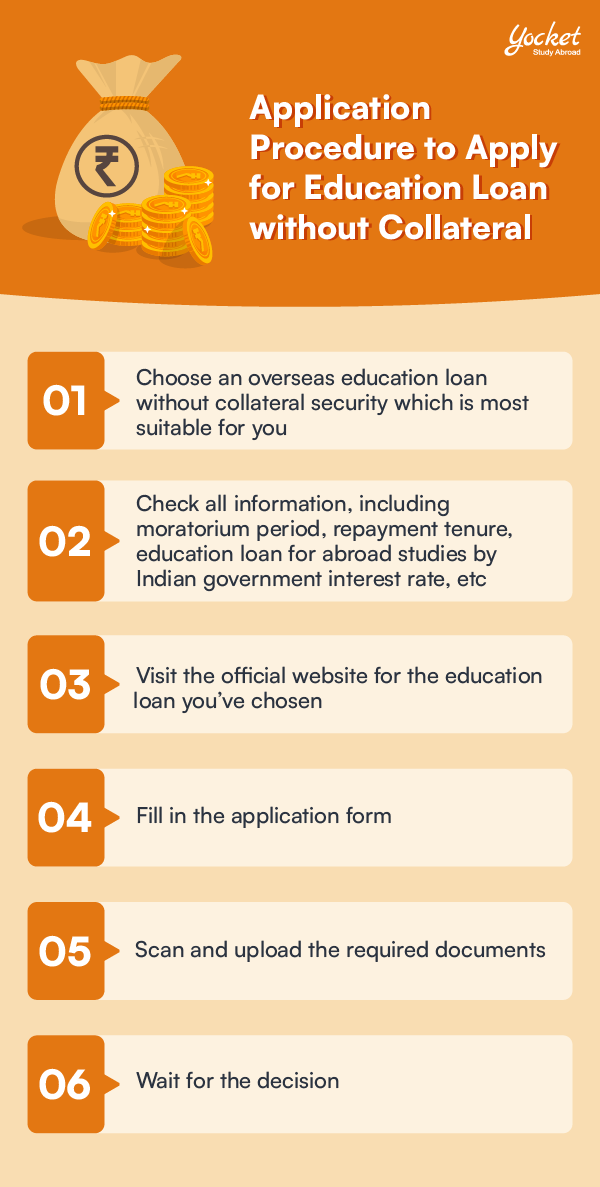

Are you concerned about financing your dream education abroad? Dive into the world of education loans without collateral, a boon for Indian students aspiring to study abroad. The increasing popularity of such loans stems from their accessibility and the growing number of Indian students seeking international education. This blog is your comprehensive guide, unraveling the details of overseas education loans without security and addressing all your queries. Worried about the financial aspect? Explore the enticing realm of non-collateral education loans as we break down the essentials for you.

Embark on a stress-free journey with Yocket Premium, with personalized guidance just for you. Navigate the complexities of funding your education abroad effortlessly with Yocket’s data-driven and user-centric approach.

It's not just a loan; it's your gateway to academic success. Apply with Yocket now and unlock a seamless path to your global education aspirations!